The First Five Years of Retirement: Taxes, Withdrawals, and Benefits

Celina Ochoa

Understanding the Early Retirement Landscape

Retirees entering their first five years of retirement often encounter unique financial challenges. From adjusting to new spending patterns to organizing tax-efficient retirement planning, this period requires strategic management to ensure long-term financial stability.

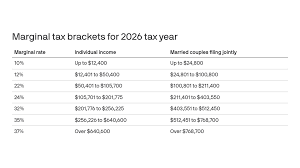

Tax Management

Taxes play a significant role in this phase. Understanding how withdrawals from different accounts affect your tax bracket is crucial. Consider utilizing tax-loss harvesting or taking distributions from tax-deferred accounts strategically to minimize tax burdens while maintaining essential income streams.

Withdrawal Sequencing

Crafting a withdrawal sequence can substantially impact financial outcomes. Prioritize withdrawing from taxable accounts to benefit from lower capital gains taxes before dipping into IRAs or 401(k)s. This strategy can preserve tax-advantaged accounts for later years when healthcare expenses may rise.

Coordinating Social Security and Medicare

Decisions around Social Security claiming age should align with healthcare coverage needs. Delaying Social Security can lead to higher monthly benefits, but you must ensure coverage under Medicare cuts potential healthcare costs, making strategic enrollment vital to maximizing benefits.

Planning Tips for Success

- Annual Reviews: Regularly analyze the financial plan to adapt to any changes in personal circumstances or legislation.

- Dynamic Adjustments: Be open to modifying strategies as health care needs or market conditions evolve.

- Professional Advice: Consider professional consultations to navigate complexities in tax-efficient retirement planning.

Call to Action

Understanding and planning for the intricacies of early retirement can enhance your financial security. Contact us today to create a customized strategy that ensures a smooth transition into retirement and optimizes your financial well-being for the years to come.

Disclaimer: To the fullest extent permissible pursuant to applicable laws, Haynie Wealth Management (referred to as "Haynie") disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement and suitability for a particular purpose. None of the information provided in this publication is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. All sources are deemed to be reliable, but are not guaranteed and should be independently verified. In no event shall Haynie Wealth Management have any liability to you for damages, losses and causes of action for accessing this information. Past performance is not indicative of future results.