Optimize Your After-Tax Returns with Strategic Asset Location

Advanced asset location strategies can significantly boost after-tax returns by strategically allocating investments across taxable, tax-deferred, and Roth accounts. As an experienced investor, understanding these distinctions ensures efficient tax management and maximizes your portfolio’s performance.

Taxable Accounts:

Taxable accounts are best suited for investments that produce returns taxed at lower rates. These include long-term capital gains and qualified dividends. By selectively placing more tax-efficient assets here, you can minimize immediate tax burdens while preserving flexibility for withdrawals without penalties.

Tax-Deferred Accounts:

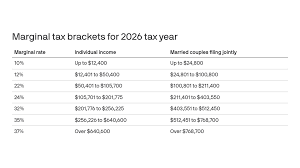

Utilize tax-deferred accounts such as traditional IRAs and 401(k)s for investments that generate ordinary income tax liabilities, such as bonds or high-yield equities. These accounts allow your investments to grow tax-free until withdrawal, effectively deferring taxes and potentially lowering your tax bracket in retirement.

Roth Accounts:

Roth IRAs or Roth 401(k)s, which offer tax-free growth and withdrawals, are ideal for high-growth stocks or investments expected to appreciate significantly over time. Since contributions are made with after-tax dollars, any appreciation and qualified withdrawals remain untaxed, enhancing your after-tax returns.

Strategic Considerations:

- Balance Risk and Tax Profiles: Allocate based on both the tax implications and the risk profiles of different investment types.

- Diversification: Ensure diversification across asset classes in each account type to protect against market volatility.

- Regular Reevaluation: Asset location should be regularly reevaluated as tax laws, income levels, and market conditions change, requiring dynamic adjustments to your strategy.

Call to Action:

Implementing a robust asset location strategy enhances your investment returns and aligns with overall financial goals. To explore how to optimize your portfolio effectively, consider consulting with a financial advisor to craft a personalized asset location plan tailored to your needs.

Disclaimer: To the fullest extent permissible pursuant to applicable laws, Haynie Wealth Management (referred to as "Haynie") disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement and suitability for a particular purpose. None of the information provided in this publication is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. All sources are deemed to be reliable, but are not guaranteed and should be independently verified. In no event shall Haynie Wealth Management have any liability to you for damages, losses and causes of action for accessing this information. Past performance is not indicative of future results.