Maximize Your Medicare: An Open Enrollment Checklist for Retirees in North Houston

As open enrollment approaches, it’s crucial for retirees in North Houston to optimize their Medicare plans. This period is the perfect opportunity to review and adjust your healthcare coverage to suit your evolving needs, utilizing the expertise available in Medicare planning in Houston.

1. Comprehensive Plan Reviews

Start by reviewing your current Medicare plan's details. Verify that it still aligns with your healthcare needs and that any anticipated medical services are covered. Pay special attention to changes in premiums, deductibles, and out-of-pocket costs. Should any component of your plan seem inadequate or overly expensive, this is the perfect time to seek a better fit.

2. Analyze Provider Networks

Ensuring that your preferred doctors and healthcare facilities remain within your plan’s network is critical. Verify whether your current providers will still be covered starting in January. If you’re considering switching plans, compare the provider networks to avoid any disruptions in your care, especially with specialists you frequently see.

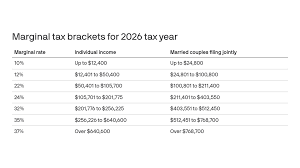

3. Understand IRMAA (Income-Related Monthly Adjustment Amount) Updates

If your income has fluctuated significantly over the past year, it’s wise to review the latest IRMAA thresholds as they may affect your premium costs. Higher income can lead to increased Medicare Part B and Part D premiums, impacting your overall budget. Consider consulting with financial advisors who specialize in Medicare planning in Houston to project and optimize these costs effectively.

Call to Action

Open enrollment is the key time to reassess and take action on your Medicare strategy. Make the most of it by partnering with skilled advisors for personalized reviews. To discuss how you can fine-tune your Medicare plan this season, contact our Medicare planning specialists today for a review tailored specifically to your needs.

Disclaimer: To the fullest extent permissible pursuant to applicable laws, Haynie Wealth Management (referred to as "Haynie") disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement and suitability for a particular purpose. None of the information provided in this publication is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. All sources are deemed to be reliable, but are not guaranteed and should be independently verified. In no event shall Haynie Wealth Management have any liability to you for damages, losses and causes of action for accessing this information. Past performance is not indicative of future results.