Fall Into Good Financial Practices For A Strong Year End

Haynie Wealth Management

As the holiday season approaches, it's easy to feel overwhelmed by the hustle and uncertainty of your financial standing. But fear not! The crisp autumn air offers a perfect chance to hit pause, reflect, and make savvy financial choices. A proactive mindset now can lead to a robust finish for this year and lay a solid foundation for a prosperous 2026. Let’s explore some essential financial habits to adopt this fall.

Revisit Your Budget

The fall season acts as the calm before the holiday spending storm. Take advantage of this time to scrutinize your income and expenses. Creating a budget cushion now can help absorb the impact of seasonal expenditures. Whether it’s setting aside funds for holiday gifts or travel, a well-thought-out budget can save you from financial stress later.

Set Year-End Goals

The year isn’t over yet—there’s still time to achieve meaningful financial wins. Consider what you can accomplish before the year ends, like paying off a debt, increasing your emergency savings, or maxing out your retirement contributions. Defined goals will provide a clear path to ending the year on a strong note.

Automate Savings

Automation can be your best friend when it comes to saving money. Set up automatic transfers to savings or investment accounts and watch your nest egg grow. Even small amounts add up over time, and taking action now can make a significant difference in the future.

Pay Down High-Interest Debt

Carrying high-interest debt, especially credit card balances, can be costly in the long term. Implement repayment strategies to tackle these debts and earn some financial breathing room. This will position you better financially as the new year begins.

Put Idle Money to Work

Take a moment to evaluate where your money is currently resting. Consider shifting funds into higher-yield accounts or investment options that align with your risk tolerance and timeline. Putting idle money to work can yield greater financial growth and security.

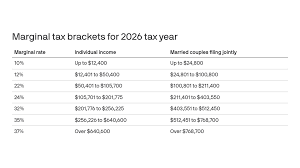

Schedule a Year-End Financial Review

Meeting with your financial advisor before the end of the year can optimize your finances for tax efficiency and refine your financial plan. It’s a pivotal time to ensure you are set up for success in 2026.

This fall, embrace the opportunity to fine-tune your finances. Remember, even small, intentional actions can lead to significant progress. There’s no better time than now to book a financial review and get personalized support to maintain momentum into the new year.

Disclaimer: To the fullest extent permissible pursuant to applicable laws, Haynie Wealth Management (referred to as "Haynie") disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement and suitability for a particular purpose. None of the information provided in this publication is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. All sources are deemed to be reliable, but are not guaranteed and should be independently verified. In no event shall Haynie Wealth Management have any liability to you for damages, losses and causes of action for accessing this information. Past performance is not indicative of future results.