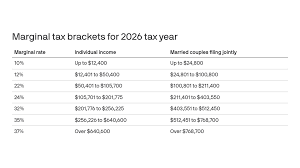

As retirees navigate their post-working years, managing Required Minimum Distributions (RMDs) becomes a critical task. Proper sequencing of RMDs can help minimize tax liabilities, manage Medicare premiums, and avoid costly penalties, ensuring a smoother financial journey.

Understanding RMD Rules

According to IRS guidelines, retirees must start taking RMDs from their IRA, 401(k), or other retirement plan accounts once they reach the age of 72. Failing to withdraw the minimum amount results in a substantial excise tax—generally 25%, which may be reduced to 10% if corrected timely within two years.

Impact on Medicare Premiums

RMDs can affect your adjusted gross income, which in turn might influence Medicare Part B and D premiums. If your income exceeds certain thresholds, you might face higher premiums due to Income-Related Monthly Adjustment Amounts (IRMAA). Therefore, managing your RMDs is essential not just for tax purposes but also for controlling healthcare costs.

Advanced Strategies for RMD Planning

- Consider Roth Conversions: By converting portions of your traditional IRA to a Roth IRA before RMDs are required, you can reduce future taxable income, as Roth IRAs do not have RMDs.

- Aggregate RMDs: If you own multiple IRAs, you can take the total RMD from one account, providing flexibility in managing withdrawals and taxes.

- Charitable Contributions: Use qualified charitable distributions (QCDs) from IRAs, which count toward RMDs but are excluded from taxable income.

Planning Tips

Start planning your RMDs early by working with a financial advisor. Calculate your required withdrawals and assess how these fit with your broader financial plan. Be proactive about adjusting your investment portfolio to align with your RMD strategy, tax situation, and potential impacts on Medicare premiums.

Seek Professional Guidance

Navigating RMD planning requires precision and foresight. A professional can provide tailored advice to ensure compliance with IRS rules while optimizing your tax situation and managing Medicare impacts. Don’t hesitate to reach out for personalized strategies that fit your financial goals.

For further assistance with RMD planning, consider consulting with our experts at Haynie Wealth Management. We offer in-depth guidance and tax-efficient planning strategies to optimize your retirement income.

Disclaimer: To the fullest extent permissible pursuant to applicable laws, Haynie Wealth Management (referred to as "Haynie") disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement and suitability for a particular purpose. None of the information provided in this publication is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. All sources are deemed to be reliable, but are not guaranteed and should be independently verified. In no event shall Haynie Wealth Management have any liability to you for damages, losses and causes of action for accessing this information. Past performance is not indicative of future results.