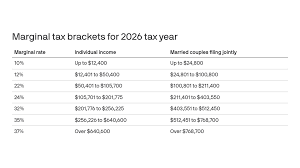

As we look ahead to 2026, major shifts are on the horizon for tax planning. The IRS recently released the official 2026 income tax brackets, reflecting changes implemented under the “One Big Beautiful Bill.” These adjustments will impact income earned in 2026, making proactive planning essential.

It's crucial to understand how these tax bracket changes might affect your financial strategy, especially if you're anticipating significant financial events like retirement, asset sales, or a boost in income. Taking action now can help optimize your long-term tax strategy and ensure you're prepared for these changes.

If you’re wondering how these developments might influence your financial planning, here are some key considerations:

- Review your income projections for 2026 to assess potential tax implications.

- Consider the impact on retirement savings and withdrawals.

- Evaluate the benefits of tax-efficient investment strategies.

- Plan for large financial transactions, like asset sales, with these tax changes in mind.

At Haynie Wealth Management, we're committed to helping you navigate these complex changes. Our expertise in tax-efficient planning ensures you’re well-prepared to adapt your strategies in response to new tax legislation. If you have questions or need assistance in reviewing your long-term tax strategy, don’t hesitate to reach out. We're here to help you plan ahead and make informed financial decisions.

Disclaimer: To the fullest extent permissible pursuant to applicable laws, Haynie Wealth Management (referred to as "Haynie") disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement and suitability for a particular purpose. None of the information provided in this publication is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. All sources are deemed to be reliable, but are not guaranteed and should be independently verified. In no event shall Haynie Wealth Management have any liability to you for damages, losses and causes of action for accessing this information. Past performance is not indicative of future results.