One of the simplest yet most overlooked parts of estate planning is keeping your beneficiary designations up to date. Retirement accounts, insurance policies, and trusts all rely on beneficiary forms, not your will, to determine who inherits those assets. If these designations are outdated, you risk unintentionally disinheriting loved ones or creating unnecessary conflict.

That's why an annual beneficiary review should be a cornerstone of your financial routine.

Why Beneficiary Reviews Matter

Life changes quickly—marriages, divorces, births, deaths, and even changes in your financial goals can all impact who should inherit your assets. Without regular updates, your hard-earned wealth may not go where you intended. An annual review helps ensure your estate plan reflects your current wishes and avoids costly surprises for your heirs.

Retirement Accounts: More Powerful Than Your Will

Beneficiary designations on retirement accounts, such as IRAs and 401(k)s, take precedence over your will. Even if your will leaves everything to your children, an outdated beneficiary form could legally pass your account to someone else—such as an ex-spouse.

By reviewing these designations each year, you:

- Confirm that your current wishes are reflected.

- Protect against unintentional disinheritance.

- Align your accounts with your broader estate plan.

Insurance Policies: Critical Protection for Loved Ones

Life and health insurance policies often form the backbone of financial protection in retirement. However, if your beneficiaries are outdated, the proceeds may not reach the people you intended to support.

A yearly check ensures that:

- Your listed beneficiaries match your estate planning goals.

- Your policy values still meet your family's financial needs.

- Potential legal disputes or delays in distribution are avoided.

Trusts: Effective Only If They're Current

Trusts can offer significant tax advantages and provide greater control over how your wealth is distributed. But even the best-drafted trust is only effective if the beneficiary provisions are correct and up to date.

Annual reviews help ensure that your trust continues to:

- Reflect your current intentions.

- Maintain eligibility for tax advantages.

- Provide a smooth and efficient transfer of assets.

Before making any changes to your trust or legal documents, it's important to consult a licensed attorney in your state.

The Role of Professional Guidance

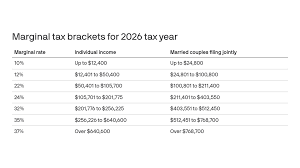

Beneficiary reviews may seem straightforward, but they often tie into larger estate planning and tax considerations. For example, naming the wrong beneficiary on a retirement account can create unexpected tax burdens. Working with a financial advisor, attorney, or tax professional helps you make informed decisions that align with your broader goals.

Take the Next Step

Don't let outdated paperwork undo years of careful planning. A beneficiary review is quick, proactive, and one of the most effective ways to protect your legacy.

Schedule your annual estate and beneficiary review with our team today to ensure your wealth goes exactly where you intend—providing clarity, confidence, and peace of mind for you and your loved ones.

Disclaimer: To the fullest extent permissible pursuant to applicable laws, Haynie Wealth Management (referred to as "Haynie") disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose. None of the information provided in this publication is intended as investment, tax, accounting, or legal advice, or as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. All sources are deemed to be reliable, but are not guaranteed and should be independently verified. In no event shall Haynie Wealth Management have any liability to you for damages, losses, and causes of action for accessing this information. Past performance is not indicative of future results.