What Adults With Student Loans Should Understand About Planning for Retirement

Haynie Wealth Management

Managing Student Debt While Preparing for the Future

Across the United States, two financial pressures weigh heavily on many adults: student loans and retirement savings. More than 43 million borrowers still carry student loan balances, and a significant number continue paying those loans well into midlife or even later. With so much income tied to repayment, it’s easy for long‑term retirement goals to fall behind.

At the same time, studies consistently show that many Americans feel unprepared for retirement—particularly high‑net‑worth (HNW) earners and professionals in the middle of their careers who are juggling multiple financial responsibilities. With February recognized as Financial Aid Awareness Month, this is an ideal moment to pause and consider how student loan repayment and retirement planning can work together rather than compete for priority.

Whether you’re paying off Parent PLUS loans, managing your own student debt, or helping a child with college expenses, here are key insights that can help you stay on track for retirement while handling loan repayment.

Take Advantage of SECURE 2.0 Employer Benefits

A major development for borrowers came with the SECURE 2.0 Act, which allows employers to match student loan payments with contributions to retirement plans such as 401(k)s. If your employer offers this feature, each qualifying student loan payment you make can trigger a matching contribution—even if you’re not personally adding money to the retirement plan at that time.

This change is significant because it enables you to grow retirement savings without shifting funds away from your loan repayment strategy. You benefit from the power of compounding while still reducing your student debt. This can be especially beneficial for early- and mid‑career professionals who want to pay down their loans faster but don’t want to lose ground on long-term savings goals.

To find out whether your company participates, reach out to your Human Resources team or retirement plan administrator. They can walk you through how the matching works and what steps you need to take to enroll.

Be Deliberate With Extra Loan Payments

Making additional payments toward your student loans is a smart way to reduce the balance more quickly, but it only works as intended when those funds are applied correctly. Many loan servicers automatically place extra payments toward future scheduled payments instead of lowering your principal balance. While this may make it seem like you’re ahead, it does little to reduce the amount of interest that accumulates over time.

If you want to speed up repayment and cut down the total interest you pay, you’ll need to request—preferably in writing—that extra payments go directly toward the principal. This simple but important step can shorten the life of your loan and lessen your long-term financial burden.

If you’re uncertain how your payments are being applied, contact your loan servicer for clarification and keep documentation of your request.

Use Pre‑Tax Retirement Contributions to Lower IDR Payments

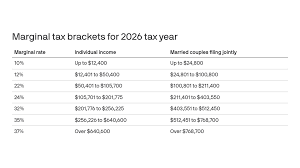

Borrowers using an income-driven repayment (IDR) plan may gain a significant advantage by contributing to a pre-tax retirement account such as a traditional 401(k), 403(b), or SIMPLE IRA. Because your IDR payment is based on your adjusted gross income (AGI), reducing your AGI through retirement contributions also reduces your required monthly student loan payment.

This strategy accomplishes two important goals at once. You continue building retirement savings on a tax‑deferred basis while simultaneously managing your student debt more effectively. For those working toward Public Service Loan Forgiveness (PSLF) or other long-term forgiveness programs, lowering your AGI could increase the total amount ultimately forgiven.

For RIAs, wealth and retirement (W&R) professionals, and HNW individuals with complex financial layers, this approach can make a measurable difference in long-term planning outcomes.

Factor Loan Forgiveness Into Your Long-Term Strategy

Borrowers eligible for loan forgiveness programs—typically with time frames between 10 and 25 years—should consider whether aggressively paying off loans is the best financial approach. While paying down your balance quickly can feel rewarding, it may reduce the benefits of forgiveness and limit funds available for retirement contributions.

If forgiveness is a realistic option, it may be more strategic to contribute more to retirement accounts, which lowers your AGI, decreases your monthly payments, and increases the amount forgiven over time. Meanwhile, those retirement contributions continue to grow tax‑deferred, improving your long-term financial outlook.

Stepping back to evaluate your entire financial picture—debt, savings, income, and goals—can help you decide how to balance repayment with retirement planning in a way that serves your future best.

Smart Planning Helps You Move Forward on Both Fronts

Paying off student loans and saving for retirement doesn’t have to be an either/or decision. You can make progress on both objectives by choosing strategies that align with your income, tax situation, and long-term goals. That might mean confirming your eligibility for SECURE 2.0 loan-payment matching, ensuring extra payments apply to your principal, increasing pre-tax retirement contributions under an IDR plan, or determining whether forgiveness programs apply to you.

For those with multiple priorities, sophisticated income structures, or HNW considerations, working with a financial advisor can provide clarity and structure. An advisor can help model potential outcomes, assess tax implications, and design a plan tailored to your circumstances.

The Bottom Line: You Can Build Toward Retirement While Managing Student Debt

The belief that you must choose between paying down student loans and saving for retirement is outdated. With the right strategies—and with programs like SECURE 2.0, IDR plans, and forgiveness pathways—balancing both goals is more achievable than ever.

Financial Aid Awareness Month serves as a reminder that financial knowledge matters at every life stage, not just during school. If you’re navigating repayment while planning for your future, now is a great time to reassess your approach and create a plan that supports both debt reduction and long‑term financial security.

If you’d like help reviewing your financial picture or planning your next steps, reach out for support. A personalized strategy can help you reduce your loan burden, strengthen your retirement savings, and feel more confident about what lies ahead.

Disclaimer: To the fullest extent permissible pursuant to applicable laws, Haynie Wealth Management (referred to as "Haynie") disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement and suitability for a particular purpose. None of the information provided in this publication is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. All sources are deemed to be reliable, but are not guaranteed and should be independently verified. In no event shall Haynie Wealth Management have any liability to you for damages, losses and causes of action for accessing this information. Past performance is not indicative of future results.