June Celebrates National Annuity Awareness Month

With June marking National Annuity Awareness Month, it's a perfect time to explore how annuities could be a pivotal part of your retirement planning. Economic uncertainties, such as market volatility and rising interest rates, often make it challenging to find financial security. Annuities offer an avenue for stability amid these unpredictable times.

Are More People Choosing Annuities?

Annuities are gaining traction, with sales hitting a record $432.4 billion in 2024—a 12% increase from 2023. While projections for 2025 are more moderate, annuities continue to hold a valuable spot in diverse retirement portfolios, appealing for their ability to provide consistent income streams.

What Is an Annuity?

At its core, an annuity is a financial product that involves paying an insurance company in exchange for regular income later—either for a determined period or for life. This product is designed to ensure a stable financial future, vital during the post-retirement phase.

Why Consider an Annuity?

The benefits of annuities are multifaceted. They offer lifetime income, crucial for long-term financial security. Additionally, they provide legacy planning features such as death benefits. A notable advantage is tax-deferred growth, where the "triple tax benefit" allows the principal, interest, and tax savings to earn interest. Certain types of annuities even offer market protection, safeguarding your investments from economic downturns.

What Are the Downsides of Annuities?

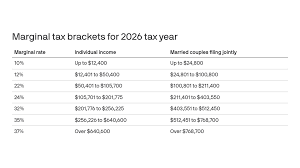

Despite their benefits, annuities have their downsides. High fees are a concern, encompassing sales charges, administrative fees, and investment management costs. Other risks involve rising interest rates, inflation, and potential insurer failure—though state guaranty associations offer some protections. It's also important to consider the tax implications and penalties for early withdrawals, such as ordinary income tax and surrender charges.

A Customizable Financial Tool

Annuities aren’t one-size-fits-all solutions but can be a powerful tool within specific retirement strategies. To gauge if annuities might fit into your financial plan, consider consulting a financial professional who can tailor advice to your unique situation and objectives.

Disclaimer: To the fullest extent permissible pursuant to applicable laws, Haynie Wealth Management (referred to as "Haynie") disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement and suitability for a particular purpose. None of the information provided in this publication is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. All sources are deemed to be reliable, but are not guaranteed and should be independently verified. In no event shall Haynie Wealth Management have any liability to you for damages, losses and causes of action for accessing this information. Past performance is not indicative of future results.