Understanding Step-Up in Basis

Under tax law, the "step-up in basis" rule allows an inheritor to adjust the original value of an inherited asset to its market value at the time of the owner's death. This adjustment can substantially reduce the capital gains tax that heirs might face should they decide to sell the asset.

Example of Step-Up in Basis

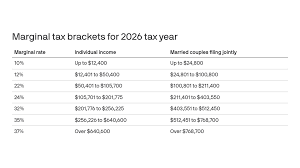

Consider a scenario in which a parent purchased stock at $50,000 and, by the time of passing, the stock's value had appreciated to $150,000. With a step-up in basis, the stock's value is reset to $150,000. If the heir sells the stock at this new basis value, the capital gains tax would be negligible, reflecting just the difference between this new basis and the sale price.

Planning Opportunities

Integrating step-up in basis into estate planning offers significant opportunities for tax optimization. This approach is particularly beneficial for appreciating assets like real estate, stocks, and mutual funds. By potentially resetting the asset's worth, heirs can avoid high capital gains taxes, adding another layer of financial efficiency to estate plans.

Strategies for Heirs

- Hold Rather than Sell: Heirs might consider holding onto assets when possible, understanding that major tax benefits occur at the time of inheritance.

- Timely Sales: If an immediate sale is necessary, selling shortly after inheritance can capitalize on the step-up value, further minimizing tax implications.

- Coordination with Estate Planning: Regular estate reviews can help identify which assets are best suited to this strategy, aligning with both the estate owner's and the heirs’ financial goals.

Call to Action

Utilizing the step-up in basis effectively requires careful planning and professional advice. Contact us today to explore customized estate planning advice that harnesses this and other strategies to secure optimal outcomes for you and your heirs.

Disclaimer: To the fullest extent permissible pursuant to applicable laws, Haynie Wealth Management (referred to as "Haynie") disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement and suitability for a particular purpose. None of the information provided in this publication is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. All sources are deemed to be reliable, but are not guaranteed and should be independently verified. In no event shall Haynie Wealth Management have any liability to you for damages, losses and causes of action for accessing this information. Past performance is not indicative of future results.