Jump-Start Your Financial Health This January: A Practical Guide to Getting Back on Track

Celina Ochoa

January is the perfect time to take a closer look at your finances and set the stage for a more intentional year. One of the most effective places to begin is by reviewing last year’s spending. Examining your 2025 expenses can uncover helpful insights. Whether it’s subscriptions you rarely use, spending categories that routinely run high, or opportunities to shift money toward goals that truly matter to you. It’s often surprising how small recurring charges, from occasional takeout to monthly streaming services, can quietly add up over 12 months.

Taking the time to identify these spending patterns now allows you to make meaningful adjustments for the year ahead. Simple changes, such as redirecting $100 per month from discretionary purchases to debt reduction or investment contributions, can yield noticeable long-term benefits. The purpose of this review isn’t to cut out everything enjoyable; it’s to make sure your spending supports your values and the future you envision.

Refresh Your Goals and Build a Purposeful Budget

Once you’ve assessed your spending, updating your financial goals is a natural next step. Goals evolve over time as life changes, whether you’re preparing for a major milestone like buying a home or staying focused on long-term priorities such as retirement. A helpful approach is to break goals into three categories: short-term (within the next three years), medium-term (three to ten years), and long-term (beyond ten years).

After clarifying what you’re working toward, you can fine-tune your budget to ensure it supports these priorities. A good budget isn’t meant to feel confining; it’s a plan that assigns purpose to your money and helps you build momentum. Frameworks like the 50/30/20 guideline can give your budget structure while remaining flexible. Under this method, 50% of your income goes toward needs, 30% toward wants, and 20% toward savings and debt repayment.

Give Your Portfolio a New-Year Checkup

January is also an excellent time to conduct a wellness check on your investment portfolio. Reviewing your investments annually helps confirm they are performing as expected and remain aligned with your long-term strategy and risk tolerance. Your investment mix should consider where you are in your financial journey. For example, someone retiring in fifteen years may have a different allocation approach than someone planning to stop working in five.

This review shouldn’t stop with investments. It’s also a good moment to look at your emergency fund. Ideally, you should have enough saved to cover three to six months of living costs. If you tapped into that fund during 2025, planning to rebuild it now can help restore financial security and prepare you for unexpected expenses in the year ahead.

Develop Mindful Financial Habits

Beyond annual check-ins, developing mindful money habits can have a meaningful impact on your financial wellness. These habits focus on the everyday choices that shape your financial future. For example, pausing before making a purchase can help you decide whether it supports your goals. Setting up automatic transfers to savings or investment accounts is another effective way to keep yourself on track without constant effort.

Regularly monitoring your spending, even just once or twice a month, helps maintain accountability and can prevent small issues from growing into bigger ones. Adding simple routines, such as monthly financial reviews or reminders to check account balances, can reduce stress, improve confidence, and build a sense of control over your financial life.

Boost Your Retirement Savings Early in the Year

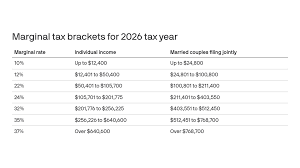

Enhancing your retirement contributions is another smart step as the new year begins. Adding funds early gives your money more time to grow through compounding. Contributing to accounts such as a 401(k) or IRA at the start of the year, rather than waiting until the end, can potentially provide several extra months of investment growth. Since contribution limits for 2026 may have changed, it’s worth verifying the updated guidelines to ensure you're maximizing your opportunities.

Even small adjustments can make a significant difference. Increasing your retirement contribution rate by just 1% or 2% can meaningfully impact your long-term savings. For those closer to retirement age, catch-up contributions offer a valuable way to bolster your nest egg. And if your employer offers matching contributions, be sure to take advantage of them. This is essentially free money that helps accelerate your progress.

Start the New Year with Confidence

January presents an ideal opportunity to reset your financial habits, clarify your goals, and build a plan that supports the life you want. By reviewing your spending, refreshing your goals, checking in on your investments, cultivating mindful habits, and boosting retirement contributions, you’re setting a foundation for a stronger, more organized financial year. Small, consistent actions can lead to impressive progress over time, and the start of a new year is the perfect time to begin.

Disclaimer: To the fullest extent permissible pursuant to applicable laws, Haynie Wealth Management (referred to as "Haynie") disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement and suitability for a particular purpose. None of the information provided in this publication is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. All sources are deemed to be reliable, but are not guaranteed and should be independently verified. In no event shall Haynie Wealth Management have any liability to you for damages, losses and causes of action for accessing this information. Past performance is not indicative of future results.